Welcome to my personal website.

I am Chunjie Wang. I am an assistant professor in finance at KU Leuven. I obtained PhD in finance at Stockholm School of Economics. My research interest lies in empirical asset pricing, and machine learning applications.

You can reach me by my social accounts or by email: chunjie.wang@kuleuven.be

Working Paper

Asset pricing, not equity pricing

job market paper

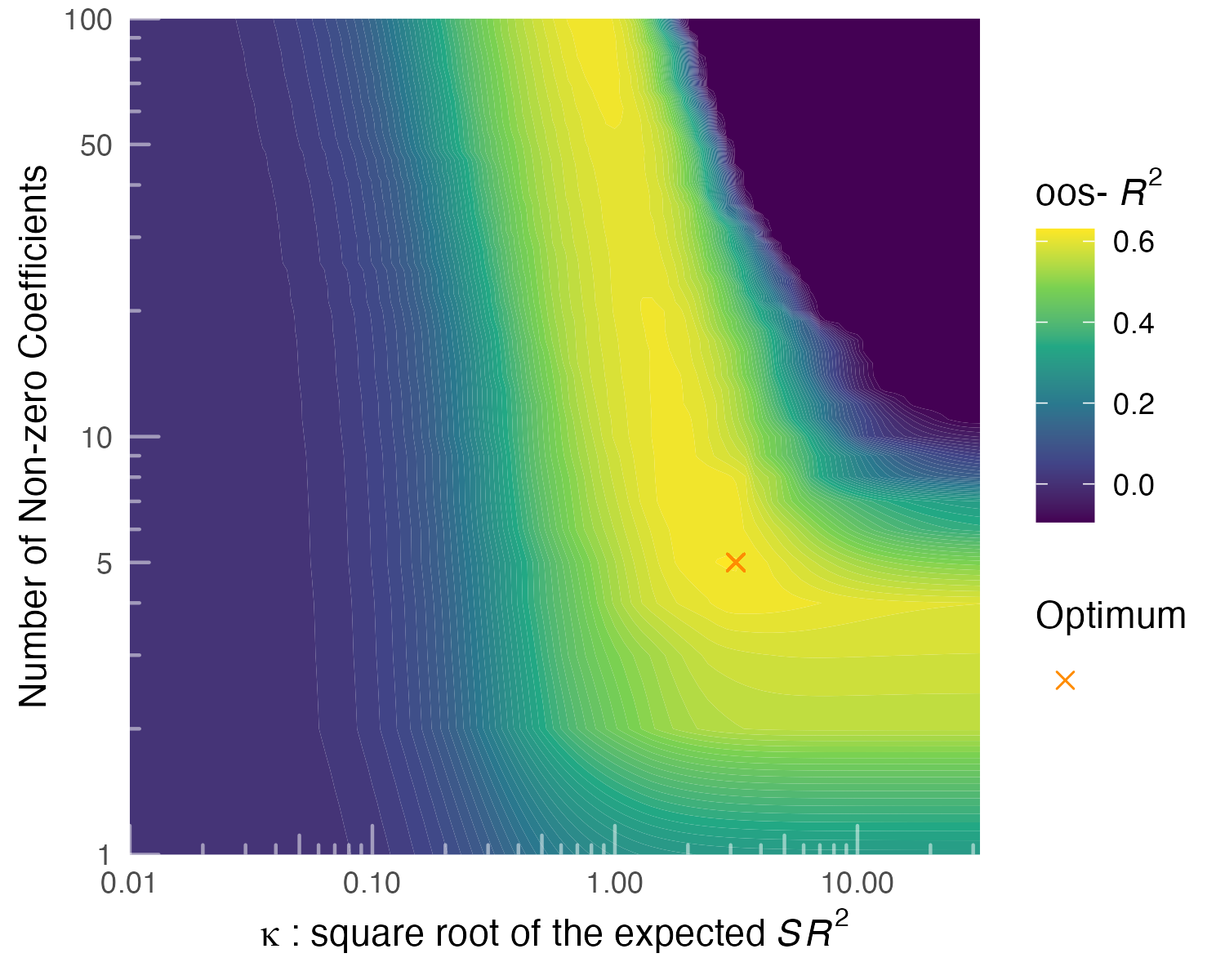

This paper demonstrates that building characteristics-managed factors using firms' asset returns greatly reduces the number of factors necessary to explain the cross-section. A 5-factor model based on asset returns explains 62.4% of the variation in 100 factors, whereas an 88-factor model using equity returns explains only 38.6%. Out-of-sample, the asset-based implied mean-variance-efficient (MVE) portfolio achieves a Sharpe ratio of 1.2, compared with 0.75 for its equity-based counterpart. The parsimonious asset-based model explains equity returns better than the equity-based model, as it reduces the number of equity anomalies to 15 compared with 23 for the latter. The nonlinear transformation of returns caused by leverage increases the loadings of firms with high leverage on the equity-based factors, exposes these factors to firm-level systematic risks that would not arise in asset-based factors, and contributes to the factor zoo.

Betting on Stocks with Options??

with Adrien d’Avernas, Christian Schlag, Tobias Sichert, and Martin Waibel

We use machine learning to examine the predictability of hold-to-maturity returns on single stock options. In sharp contrast to the implications of standard asset pricing theory, we find that the expected return of the underlying stock fails to forecast option returns, but does explain cross-sectional variation in option prices. Option trading strategies based on the underlying’s expected stock return deliver anomalously low returns. These findings challenge canonical option pricing models and suggest that options are not a suitable instrument to harvest stock risk premia.